kansas vehicle sales tax estimator

How to Calculate Kansas Sales Tax on a Car. Maximum Local Sales Tax.

Motor Vehicle Division Unified Government Of Wyandotte County And Kansas City

The max combined sales tax you can expect to pay in Kansas is 115 but the average total tax rate in Kansas is 8477.

. Kansas has a 65 sales tax and Wyandotte County collects an additional. The Kansas Department of Revenue offers this Tax Calculator as a public service to provide payers of Kansas income tax with information to estimate their overall annual Kansas income. Title and Tag Fee is 1050.

There are also local taxes up to 1 which will vary depending on region. Kansas State Sales Tax. To calculate the sales.

Title fee is 800 tag fees vary according to type of vehicle. The sales tax in. You will find the basic fees for estimating the cost to tag a newly purchased vehicle in the table below.

Schools Special Hunting Opportunities. For your property tax amount use our Motor Vehicle Property Tax Estimator or call 316 660-9000. Effective July 1 2002 if the vehicle is purchased in a taxing jurisdiction that has a lower.

The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. Modernization Fee is 400. Average Local State Sales Tax.

For your property tax amount use our Motor Vehicle Property Tax Estimator. Search for Vehicles by VIN -Or- Make Model Year -Or- RV Empty Weight Year. In addition the Department has established a dedicated phone line specifically for the COVID-19 Retail.

Use the Kansas Department of Revenue Vehicle Property Tax Calculator. Kansas collects a 73 to 8775 state sales tax rate on the purchase of all vehicles. You will pay property tax when you initially register a vehicle and each year when you renew your vehicle registration.

Title and Tag Fee is 1050. Search for Vehicles by VIN -Or- Make Model Year -Or- RV Empty Weight Year. The total sales tax rate in any given location can be broken down into state county city and special district rates.

Kansas has a 65 statewide sales tax rate but also has 377 local. Kansas Department of Revenues Division of Vehicles launched KnowTo Drive Online a web-based version of its drivers testing exam powered by Intellectual Technology Inc. Kansas 105 county treasurers handled vehicle registration tags and renewals.

Kansas Vehicle Property Tax Check - Estimates Only. Title fee is 800 tag fees vary according to type of vehicle. Kansas Vehicle Property Tax Check - Estimates Only.

Kansas has a 65 statewide sales tax rate but also. Estimating the Cost to Tag a Newly Purchased Vehicle. Maximum Possible Sales Tax.

A sales tax receipt is required if you have purchased the vehicle from a Kansas motor vehicle dealer. Claimants have until April 15 2023 to file an application for this financial assistance. There are also local taxes up to 1 which will vary depending on region.

In addition to taxes car. Vehicle Property Tax Estimator. Use this online tool from the Kansas Department of Revenue to help calculate the amount of property tax you will owe on your vehicle.

Marion County Treasurers office is now offering a new service that you can use to estimate the cost of your vehicle renewals or new. The sales tax in Sedgwick County is 75 percent InterestPayment Calculator Sales Tax Calculator. The treasurers also process vehicle titles and can register vehicles including personalized license plates.

Sales Tax On Cars And Vehicles In Kansas

Tax Calculator Chanute Ks Official Website

Used 2020 Nissan Rogue For Sale In Junction City Ks With Photos Cargurus

Register A Newly Purchased Vehicle Unified Government Of Wyandotte County And Kansas City

Kansas Department Of Revenue Division Of Vehicles Home Page

Missouri Vehicle Registration Of New Used Vehicles Faq

Motor Vehicle Crawford County Ks

Used 2022 Nissan Pathfinder For Sale In Wichita Ks With Photos Cargurus

Used Jeep Patriot For Sale In Olathe Ks Cargurus

Auto Loan Calculator With Tax Tag Fees By State

Kansas Income Taxes 2021 2022 Ks State Tax Forms Refund Facts

What S The Car Sales Tax In Each State Find The Best Car Price

Kansas Department Of Revenue Division Of Vehicles Vehicle Tags Titles And Registration

1951 Motor Vehicle Registration Nash Car Kansas City Mo Automobile Ebay

Kansas Sales Tax Rate Rates Calculator Avalara

Dmv Fees By State Usa Manual Car Registration Calculator

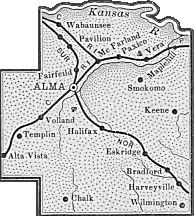

Tag Information Wabaunsee County Ks

Motor Vehicle Division Unified Government Of Wyandotte County And Kansas City

Tag And Taxes Treasurer S Office Reno County Ks Official Website